THE Reserve Bank of Zimbabwe (RBZ) has, with immediate effect, ordered that all EcoCash agents are barred from carrying out cash-in and cash-out transactions, saying the facilities were being abused to carry out illegal selling of cash at high cost to the public.

The RBZ also says the money transfer agents are barred from carrying out cash-back transactions.

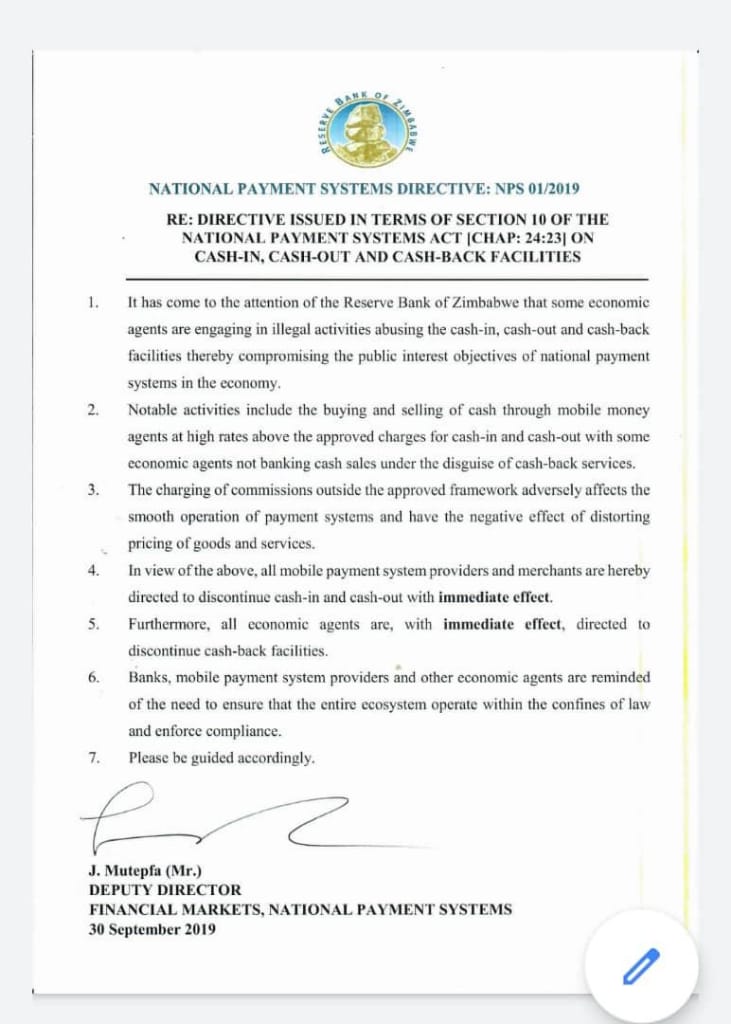

In a statement issued Monday by the central bank’s Deputy Director for Financial Markets and National Payments Systems, banks and mobile payments service providers have been advised to ensure they stay in compliance with the new directive.

“It has come to the attention of the Reserve Bank of Zimbabwe that some economic agents weere engaging in illegal activities abusing cash-in, cash-out and cash-back facilities thereby compromising the public interest objectives of national payments systems in the economy,” says the RBZ.

Some agents were charging as high as 50% for cash, with the commuting public having no option but to buy the cash as commuter operators have been slow to accept EcoCash and other non-cash forms of payments. Recently, Strive Masiyiwa, the founder and executive chairman of Econet, which owns EcoCash, blamed the selling of cash by EcoCash agents on the monetary authorities.

Masiyiwa said that the problem was shortage of bond notes in circulation, leading to arbitrage by the agents.

EcoCash is the largest mobile money transfer platform in Zimbabwe, accounting for over 90% of the market.

zimbolivenews has learnt that The RBZ has given a directive to Mobile Money Service Providers to remove Cash In, Cash Out and cashback facilities in a bid to crackdown on illegal currency trading. The RBZ has taken the fight to another level as last week froze Accounts belonging to Sakunda,Croco Motors.

The Latest move to suspend cash in and cashout facilities could deal a death blow to the black market.

1. It has come to the attention of the Reserve Bank of Zimbabwe that some economic agents are engaging in illegal activities abusing the cash-in, cash-out and cash-back facilities thereby compromising the public interest objectives of national payment systems in the economy.

2. Notable activities include the buying and selling of cash through mobile money agents at high rates above the approved charges for cash-in and cash-out with some economic agents not banking

cash sales under the disguise of cash-back services.

3. The charging of commissions outside the approved framework adversely affects the smooth operation of payment systems and have the negative effect of distorting pricing of goods and services.

4. In view of the above, all mobile payment system providers and merchants are hereby directed to discontinue cash-in and cash-out with immediate effect.

5. Furthermore, all economic agents arc, with immediate effect. directed to discontinue cash-back facilities.

6. Banks, mobile payment system providers and other economic agents arc reminded of the need to ensure that the entire ecosystem operates within the confines of the law and enforce compliance.

Please be guided accordingly.

J. Mutepfa (Mr.) DEPUTY DIRECTOR FINANCIAL MARKETS, NATIONAL PAYMENT SYSTEMS 30 September 2019